About those 401Ks: Choose the right point of view

Keep your wits about you when everyone else panics.

Last week, people were rattled as the US stock markets (and global equity markets, for that matter) started falling sharply in reaction to the tariff adjustments.

People were lamenting on X about their 401Ks becoming 200K's again—fearful of "losing money". But the real thing to focus on is purchasing power, not "price".

There's a perspective here that can make this apparently "awful" situation much more palatable (hint: is 42 > 28?) so read on.

First, though, I have to shine a spotlight on a reality that too many people are only dimly aware of.

The fact is, we have been facing the slow inflation of an "everything bubble" for nearly a decade, with prices of literally everything —stocks, crypto, tuition, housing, groceries, oil and gas, you name it —on a steady upward path.

People tend to forget this when the markets are green and "number go up" (as they say in cryptocurrency circles.)

Whistling past the graveyard, one might say.

I used to say, when explaining the state of the world to my daughters when they were younger: that which cannot continue... will not continue. It is only a question of when and how violent the correction will be.

The everything bubble "feels" all good (at least, to those who are insulated from the pain of it) until someone shows up with pin, though in reality the ballooning "price" masks a deep underlying ill health as price moves steadily further away from "value".

There is a generational gap in understanding about certain aspects of this "everything bubble", such as real estate. I used to hear my ex in-laws (who are in their late 70's now) talk about how California real estate was a “sure thing”.

Just buy a house and hold on, they said. Home "values" (they chose the wrong word, unknowingly) "always go up."

I tried to explain the fallacy to them once. When they bought their first house in the 70's, they paid something like $19,000. When they sold and moved to a more exclusive neighborhood in the mid 2000's, they sold at $575K and took their grandfathered in property tax bill (on the $19K) with them. What a deal.

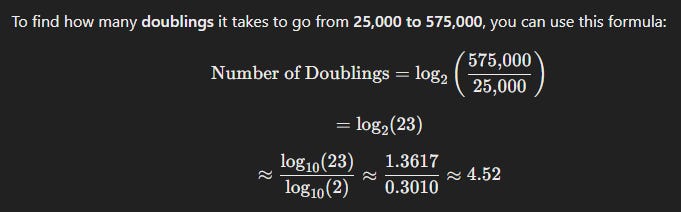

That price increase represented about five doublings; for math types, 2 to the 5th power = 32; that is, 32 x 19,000 is just over 600K. So that means their initial purchase price went up by a factor of almost 32 in round numbers.

In 2003, I bought a new home in central California for just under $200K. The housing market insanity was just beginning that year in our area, and I could literally feel it.

The development we were living in was still building out new homes, and people would line up and camp on the sidewalk starting on Thursday nights to be first in line at the sales office on Saturday mornings when they would release a new section of lots.

The giddiness people felt about "flipping" houses, the TV shows, everyone wanting to get a real estate license and quit their day jobs—all of it—was surreal to me. I was awake, but couldn’t wake the others caught up in the mania.

During the years between 2003 and 2008, home prices (not values!) increased in our area about 22% per year.

When I tried to communicate my growing unease to friends and family, they dismissed me. "Real estate always goes up. It's a safe investment" they would say. So I did the math. Using the in laws own experience as a reference to estimate our homes potential repricing: 32 x $200K = $6.4M.

Did they really think our little three-bedroom suburban house would be "worth" $6.4M when my mortgage was due? If that were true; then why should I work? I'd make more "money" just living at home for 30 years and then retire by selling my house.

In fact, there were stories in the local papers of people in nearby towns who quit their waitressing jobs and just flipped houses every 18 - 24 months, making twice their former “income” in a "real job."

That, I knew instantly—was unsustainable. A good way to keep your wits about you in these kinds of manias is to simply ask yourself: "wait a minute...what if everyone did this? Who would make products, drive trucks, grow food and serve tables?"

But the craziness at that time in California real estate was even more radical. If prices rose at 22% per year as they had been during the insanity of the early 2000's, then by the end of my 30-year mortgage that house would be "worth" $25M.

When I explained that to them, they dismissed me. They couldn't comprehend what I was saying. In 2008....I was proven right. For a while, anyway. Then the inflation cycle began anew.

I had written a few posts on X last week pointing out that there can be a wide divergence between "the price of a thing" and "the value of a thing." That is to say, the price is (often) not reflective of the underlying value.

How can a declining 401K balance be a good thing? Well...keep reading.

To offer one more extreme example: my great grandmother lived through the Weimar hyperinflation in Germany; she was one of those people who took a wheelbarrow full of "Papiermarks" to the store — with a face value of millions of "marks" — just to buy a loaf of bread.

Hyperinflationary times like that lay bare the disconnect that can exist between "price” and “value." In the future, be very careful in your choice of which word to use.

In recent decades (but really, ever since 1913 with the birth of the Fed and then the break from the gold standard in the 70's) inflation has been more like that slow-boiling frog in-a pot-analogy: the heat has been on, and getting hotter, but the poor frog simply didn't notice because the temperature rise was so slow.

But in the final death throes of the Biden Maladministration, when inflation became white hot (like it had been during the Carter Maladminstration when I was in high school, when there were lines around the block for gasoline and the interest rate on my parents’ home was 12.5%) we all got to directly feel the knob being turned up sharply on the stove.

I used to update this chart and publish it on X now and again to highlight just how significant the gasoline price rise was. During the COVIDiocy era in 2022, prices in my small California farming town for regular gasoline nearly touched $7 a gallon at one point.

Clearly, something has to change. More and more American families (including ours) are drowning and reaching levels of despair. We can’t afford food and necessities; we can’t afford health insurance; we can’t afford rent and taxes.

Something has to give.

I was at Costco last weekend, and for the first time in decades, I couldn't afford to buy a pack of steaks for $70. I didn't have the money for that "luxury".

So here is how the "repricing" of the everything bubble can be reframed.

Suppose, as an example, that you had $100K in your retirement account before the "market crash". If gasoline costs $3.50 a gallon before the crash, you could have converted your $100K to 28,570 gallons of gas, which has a certain well-defined utility value to you.

Ok then: what if you "lose" 30% of your portfolio value (your 100K becomes 70K) while at the same time gas prices retreat from $3.50 back down to $1.70 (where they were in 2015 and again in 2020?)

How many gallons can you buy with your post-crash, reduced $70K of 401K savings now?

The answer: roughly 42,000 gallons.

So how do the tariff wars fit into all of this? If the result of equalization of tariffs makes it economically advantageous for all parties to (eventually) have ZERO tariffs (after all, if the US charges the EU the same 25% tariff on cars that they already charge us, we might as well both agree to drop that 25% to zero, since we'd be at parity either way) then it won't just be gasoline that will drop in price (back down towards actual "value.")

It will be most everything.

If you paid attention to what just happened with Vietnam, you can see this outcome actually becoming possible. They agreed to zero tariffs. Trump has figured out a way to deflate the "everything bubble" which—after a period of painful adjustment—can actually benefit everyone, everywhere (unless you are a banking sector or wall-street elitist who benefits from inflation while the rest of humanity suffers.)

So back to the gasoline example pre- and post "market crash":

Which purchasing power would you rather your retirement savings have? Enough for 28,000 gallons, or 42,000 gallons?

Don't panic. Keep your wits.

CognitiveCarbon’s Content is a reader-supported publication. To support my writing and research work and make it so that I can afford to buy a pack of steaks at Costco again, please consider becoming a paid subscriber: at just $5 per month, it helps me support a family. It is genuinely needed.

You can also buy me a coffee here. Thank you for reading!

Nice piece. Citations were both helpful and supportive. We went "all cash" just over two and a half years ago (when we saw the insanity escalate with the Biden admin. Yes, we lost some upside market movement and, yes, we'll be gradually get back in (sans Big Pharma, retail, and "Magnificent 7" stocks. Timing the market is bad financial strategy but failing to see what a TDS-deranged media and a Trump-hating Wall Street can do to a market is just as irresponsible.

As usual, another common sense piece of writing. Why isn't this kind of logic in most people's brains? Instead they cry and protest without thinking. Remember when Herr Moore called you Saint Eric? He knew.